#NvidiaQ4RevenueSurges73% NvidiaQ4RevenueSurges73% 🚀📊

Headline: 🌐 AI Dominance Continues — Nvidia Reports Record $68.13B Q4 Revenue!

It’s Feb 25, 2026, and Nvidia just crushed expectations. #NvidiaQ4RevenueSurges73% as the chipmaker rides the global AI boom.

📊 Key Highlights

💥 Record Revenue: $68.13B for Q4, up 73% YoY.

💎 EPS: Non-GAAP diluted EPS of $1.62, up 82% YoY.

🏢 Data Center Growth: $62.3B, +75% YoY — AI & accelerated computing are fueling unprecedented demand.

📈 Full-Year FY2026: $215.9B revenue, +65% YoY.

📊 Q1 FY2027 Guidance: Projected revenue ~$78B, signaling continued momentum.

🔍 Market Insights

AI Industrial Revolution: CEO Jensen Huang attributes this explosive growth to enterprise adoption of agentic AI, accelerating the global shift toward AI-powered infrastructure.

Investor Signal: Nvidia’s record numbers aren’t just a tech story — they boost risk appetite across growth sectors, including blockchain, AI-focused ETFs, and decentralized compute.

Sector Synergy: Strong GPU demand also benefits crypto miners, DeFi protocols, and AI-driven blockchain applications — infrastructure is king.

🧠 Takeaway

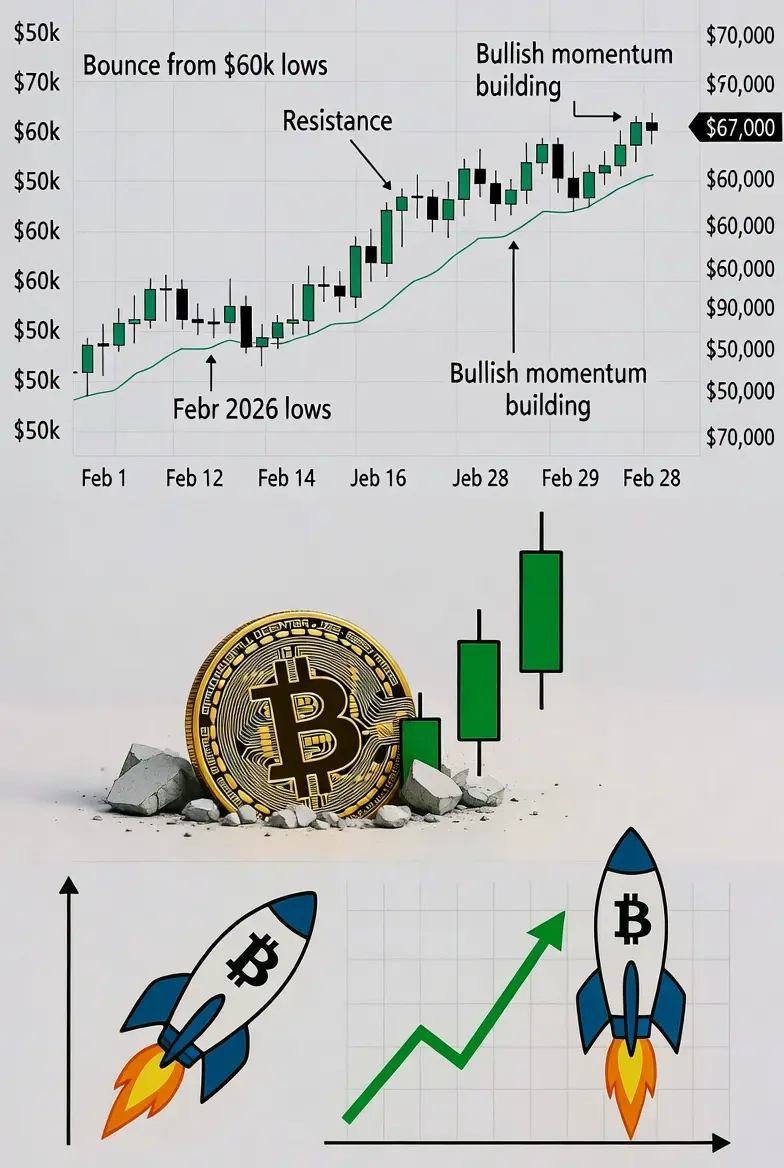

Nvidia’s results show that AI isn’t a trend — it’s a multi-year cycle reshaping tech and finance. Traders and investors watching #TechMomentum or #CryptoMarkets should note: strong leadership in AI often flows into correlated risk assets.

Are you allocating to AI + crypto synergy, or waiting for confirmation at major support zones? Drop your strategy below! 👇

#GateSquare #Investing2026

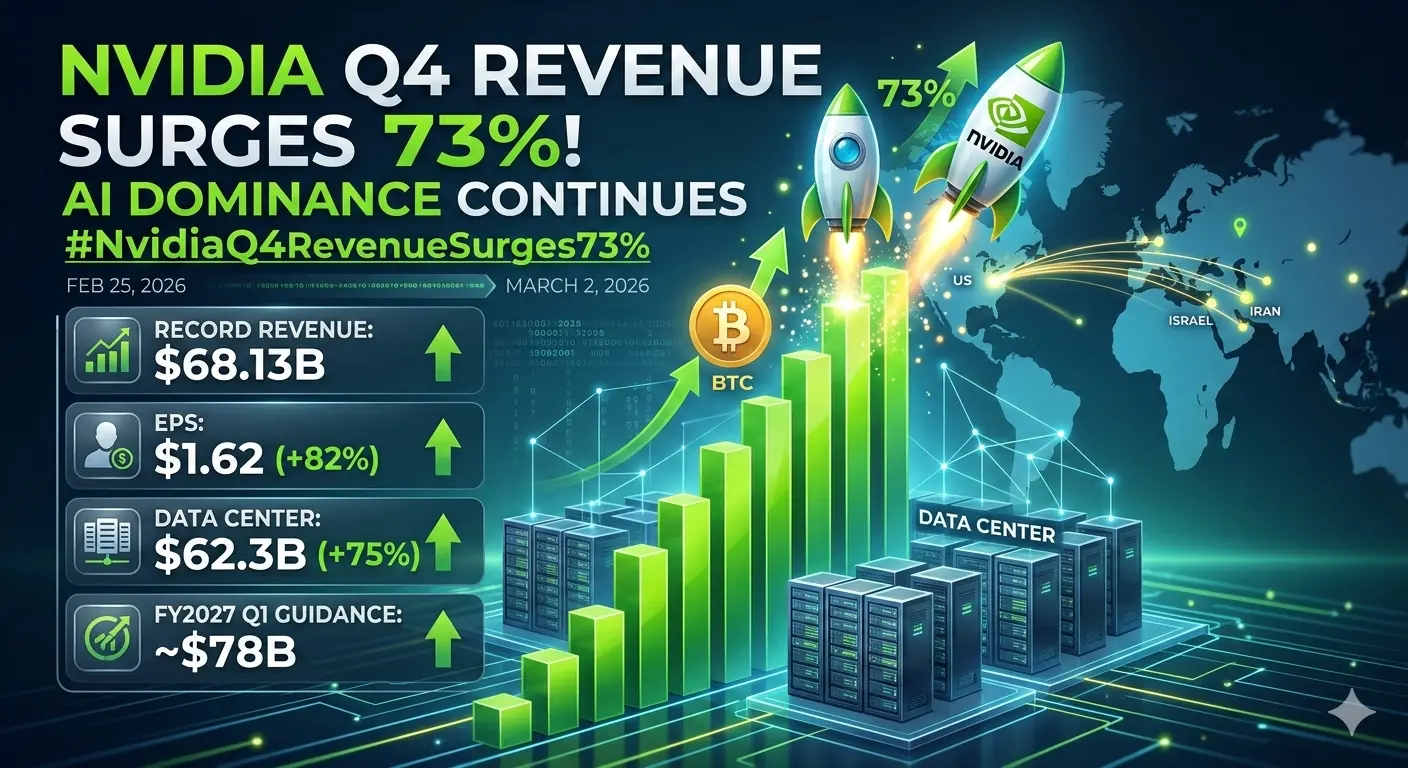

Headline: 🌐 AI Dominance Continues — Nvidia Reports Record $68.13B Q4 Revenue!

It’s Feb 25, 2026, and Nvidia just crushed expectations. #NvidiaQ4RevenueSurges73% as the chipmaker rides the global AI boom.

📊 Key Highlights

💥 Record Revenue: $68.13B for Q4, up 73% YoY.

💎 EPS: Non-GAAP diluted EPS of $1.62, up 82% YoY.

🏢 Data Center Growth: $62.3B, +75% YoY — AI & accelerated computing are fueling unprecedented demand.

📈 Full-Year FY2026: $215.9B revenue, +65% YoY.

📊 Q1 FY2027 Guidance: Projected revenue ~$78B, signaling continued momentum.

🔍 Market Insights

AI Industrial Revolution: CEO Jensen Huang attributes this explosive growth to enterprise adoption of agentic AI, accelerating the global shift toward AI-powered infrastructure.

Investor Signal: Nvidia’s record numbers aren’t just a tech story — they boost risk appetite across growth sectors, including blockchain, AI-focused ETFs, and decentralized compute.

Sector Synergy: Strong GPU demand also benefits crypto miners, DeFi protocols, and AI-driven blockchain applications — infrastructure is king.

🧠 Takeaway

Nvidia’s results show that AI isn’t a trend — it’s a multi-year cycle reshaping tech and finance. Traders and investors watching #TechMomentum or #CryptoMarkets should note: strong leadership in AI often flows into correlated risk assets.

Are you allocating to AI + crypto synergy, or waiting for confirmation at major support zones? Drop your strategy below! 👇

#GateSquare #Investing2026