InvestingWithBrandon

No content yet

InvestingWithBrandon

Poor mans covered calls are popular... but so are lottery tickets and cigarettes.

On one side you buy a LEAP call because you’re bullish, on the other you sell a call against it because you’re bearish.

Congrats... you’re now fighting yourself inside the same trade.

Most people don’t realize they’re literally strangling their own upside while pretending they “reduced risk.” and generate cash flow...

If your strategy requires "mental gymnastics" to explain how you win, you don’t have an edge, you have a hobby...

IDK about you, but I am here to make money!

On one side you buy a LEAP call because you’re bullish, on the other you sell a call against it because you’re bearish.

Congrats... you’re now fighting yourself inside the same trade.

Most people don’t realize they’re literally strangling their own upside while pretending they “reduced risk.” and generate cash flow...

If your strategy requires "mental gymnastics" to explain how you win, you don’t have an edge, you have a hobby...

IDK about you, but I am here to make money!

- Reward

- like

- Comment

- Repost

- Share

Cash secured puts are the illusion of safety with the reality of massive opportunity cost.

If you are selling puts, you are bullish... so why are you parking 100% of that capital in cash doing nothing.

You basically said, “I think this stock rips higher,” then turned around & sit on cash...

Portfolio secured puts let you be fully invested, earn premium, & still position for long term upside without the cash drag...

Keep ratios in check & no crash will wipe you out EVER.

If you are selling puts, you are bullish... so why are you parking 100% of that capital in cash doing nothing.

You basically said, “I think this stock rips higher,” then turned around & sit on cash...

Portfolio secured puts let you be fully invested, earn premium, & still position for long term upside without the cash drag...

Keep ratios in check & no crash will wipe you out EVER.

- Reward

- 1

- Comment

- Repost

- Share

🔴Covered calls are just a fancy way to say “I don’t actually believe in my own stock picks.”

If you’re truly bullish on a company, why are you selling off the upside for peanuts in premium.

And no, they don’t “protect” your downside in any meaningful way in a real crash, they just slightly soften the blow while blocking the major move higher...

If your plan to build wealth is capping your winners and generating peanuts in premium, you have a tough road ahead...

If you’re truly bullish on a company, why are you selling off the upside for peanuts in premium.

And no, they don’t “protect” your downside in any meaningful way in a real crash, they just slightly soften the blow while blocking the major move higher...

If your plan to build wealth is capping your winners and generating peanuts in premium, you have a tough road ahead...

- Reward

- like

- Comment

- Repost

- Share

The fastest way to spot a retail options trader?

They’re doing spreads.

Bull call spread, bear put spread, iron condor... Whatever.

They’re bullish & bearish at the exact same time & think it’s smart...

Then when they look at their ROI in the long run, they don't beat the SP500...

Shocker.

They’re doing spreads.

Bull call spread, bear put spread, iron condor... Whatever.

They’re bullish & bearish at the exact same time & think it’s smart...

Then when they look at their ROI in the long run, they don't beat the SP500...

Shocker.

- Reward

- like

- Comment

- Repost

- Share

You should expect volatility from the Iran situation.

But guess what.

It doesn’t matter for my portfolio.

I buy great companies at good prices.

The day to day volatility does not matter🥊

All option contracts are 1+ year in duration.

Be prepared to win either way.

But guess what.

It doesn’t matter for my portfolio.

I buy great companies at good prices.

The day to day volatility does not matter🥊

All option contracts are 1+ year in duration.

Be prepared to win either way.

- Reward

- 1

- Comment

- Repost

- Share

If this volatility scares you...

It’s because you are allocated to crap companies at crap valuations.

I sleep well at night.

Do you?

It’s because you are allocated to crap companies at crap valuations.

I sleep well at night.

Do you?

- Reward

- like

- Comment

- Repost

- Share

Selling covered calls is the most popular herd mentality "options strategy" on earth.

Let me explain.

Covered calls means you own the shares, that's what makes it covered.

If you own the shares, you are bullish right?

Hope so!

So what does selling calls actually mean?

Well, you are agreeing to sell your shares at a certain price in a certain timeframe.

Sounds good right?

You get to sell your shares for a profit and collect the premium.

In theory, sure.

But in the real world, there is a MAJOR problem.

CAPPING YOUR UPSIDE!

I can't tell you how many people I have talked to that bought shares caus

Let me explain.

Covered calls means you own the shares, that's what makes it covered.

If you own the shares, you are bullish right?

Hope so!

So what does selling calls actually mean?

Well, you are agreeing to sell your shares at a certain price in a certain timeframe.

Sounds good right?

You get to sell your shares for a profit and collect the premium.

In theory, sure.

But in the real world, there is a MAJOR problem.

CAPPING YOUR UPSIDE!

I can't tell you how many people I have talked to that bought shares caus

- Reward

- 1

- Comment

- Repost

- Share

$Q has done nothing the last few months.

But this is justified simply cause the market ran up faster then the fundamentals did.

The longer the market goes sideways/down for, the safer it becomes.

This is because EPS (profits) are slowly growing in the background and building a stronger floor under the market to take the next leg higher.

Patience.

Allocate to great companies at good prices and use longer duration options.

But this is justified simply cause the market ran up faster then the fundamentals did.

The longer the market goes sideways/down for, the safer it becomes.

This is because EPS (profits) are slowly growing in the background and building a stronger floor under the market to take the next leg higher.

Patience.

Allocate to great companies at good prices and use longer duration options.

- Reward

- like

- Comment

- Repost

- Share

For 95%+ of retail investors:

- Day trading still doesn't work.

- Swing trading still doesn't work.

- Cash secured puts still suck.

- Covered calls still suck.

- Spreads still suck.

The problem for retail "investors"?

They will continue to do the same thing & expect a different result.

Me?

- I will continue to build my base portfolio

- Sell portfolio secured puts (not cash secured)

- Buy leap calls when it makes sense

- Keep ratios in check

- Do all 1+ year option contracts

- Continue to capitalize in volatility

- Be patient & outperform 95% of all retail investors in the long term

- Day trading still doesn't work.

- Swing trading still doesn't work.

- Cash secured puts still suck.

- Covered calls still suck.

- Spreads still suck.

The problem for retail "investors"?

They will continue to do the same thing & expect a different result.

Me?

- I will continue to build my base portfolio

- Sell portfolio secured puts (not cash secured)

- Buy leap calls when it makes sense

- Keep ratios in check

- Do all 1+ year option contracts

- Continue to capitalize in volatility

- Be patient & outperform 95% of all retail investors in the long term

- Reward

- like

- Comment

- Repost

- Share

One of the biggest mistakes I see a lot of people make when they start making more money, or come into money suddenly...

Is celebrating too early and upgrading their lifestyle too quickly

Instead of using that new income as a tool to keep you earning and growing...

Don’t celebrate too early... but of course enjoy the journey.

Find the balance.

Is celebrating too early and upgrading their lifestyle too quickly

Instead of using that new income as a tool to keep you earning and growing...

Don’t celebrate too early... but of course enjoy the journey.

Find the balance.

- Reward

- 2

- Comment

- Repost

- Share

There will be a point in your life where you realize...

Going to work at your day job is actually costing you money to be there.

You'll realize your time is much more valuable than your hourly rate and you can produce MUCH more money investing or simply doing something else...

Going to work at your day job is actually costing you money to be there.

You'll realize your time is much more valuable than your hourly rate and you can produce MUCH more money investing or simply doing something else...

- Reward

- 2

- Comment

- Repost

- Share

Many people made a LOT of money the last few years in this market,

(I am one of them)

Here's the key difference though...

I will not get wiped out in a dip, correction, crash, recession, whatever.

I am positioned to not only survive a 50% crash, but to capitalize too... because if you are in this game long enough, the big crashes will come, and usually at the time you are not ready for it...

Ensure you win in upside and downside always.

Know what you own and the why behind it.

(I am one of them)

Here's the key difference though...

I will not get wiped out in a dip, correction, crash, recession, whatever.

I am positioned to not only survive a 50% crash, but to capitalize too... because if you are in this game long enough, the big crashes will come, and usually at the time you are not ready for it...

Ensure you win in upside and downside always.

Know what you own and the why behind it.

- Reward

- like

- Comment

- Repost

- Share

People on X are shocked at the $EOSE drop.

All it woulda took was 12 seconds to check the price/sales ratio to understand the valuation is extremely expensive.

Price is what you pay

Value is what you get

They key is to buy a good company at a good price.

You need both.

All it woulda took was 12 seconds to check the price/sales ratio to understand the valuation is extremely expensive.

Price is what you pay

Value is what you get

They key is to buy a good company at a good price.

You need both.

- Reward

- 1

- Comment

- Repost

- Share

Please stop day trading/swing

You’ll prob never make it like you see online.

Literally it’s a 1 in a 50,000 chance you strike gold with that.

Prob even worse.

You’ll prob never make it like you see online.

Literally it’s a 1 in a 50,000 chance you strike gold with that.

Prob even worse.

- Reward

- 2

- Comment

- Repost

- Share

Covered Calls can be a MAJOR trap...

Many ppl use them to close out if a position.

If you wanna exit, just sell the shares.

Can’t tell you how many ppl I have seen that wanna sell their over valued shares so they get greedy to sell CCs to pick up peanuts in premium.

Meanwhile the shares fall 40% and they hold the bag down...

Just sell your shares.

Don’t complicate it.

Many ppl use them to close out if a position.

If you wanna exit, just sell the shares.

Can’t tell you how many ppl I have seen that wanna sell their over valued shares so they get greedy to sell CCs to pick up peanuts in premium.

Meanwhile the shares fall 40% and they hold the bag down...

Just sell your shares.

Don’t complicate it.

- Reward

- 1

- Comment

- Repost

- Share

5 HUGE problems with the wheel strategy.

1. You sell cash secured puts (CSP suck)

2. You have a pile of cash sitting there doing nothing.

3. Selling puts is bullish, yet you have cash sitting there not working.

4. If you get assigned the shares (should be a great company at a good price if you truly were bullish selling the put) the strategy says to sell CCs.

5. Why would you wanna cap upside by selling CCs on something you are bullish on...

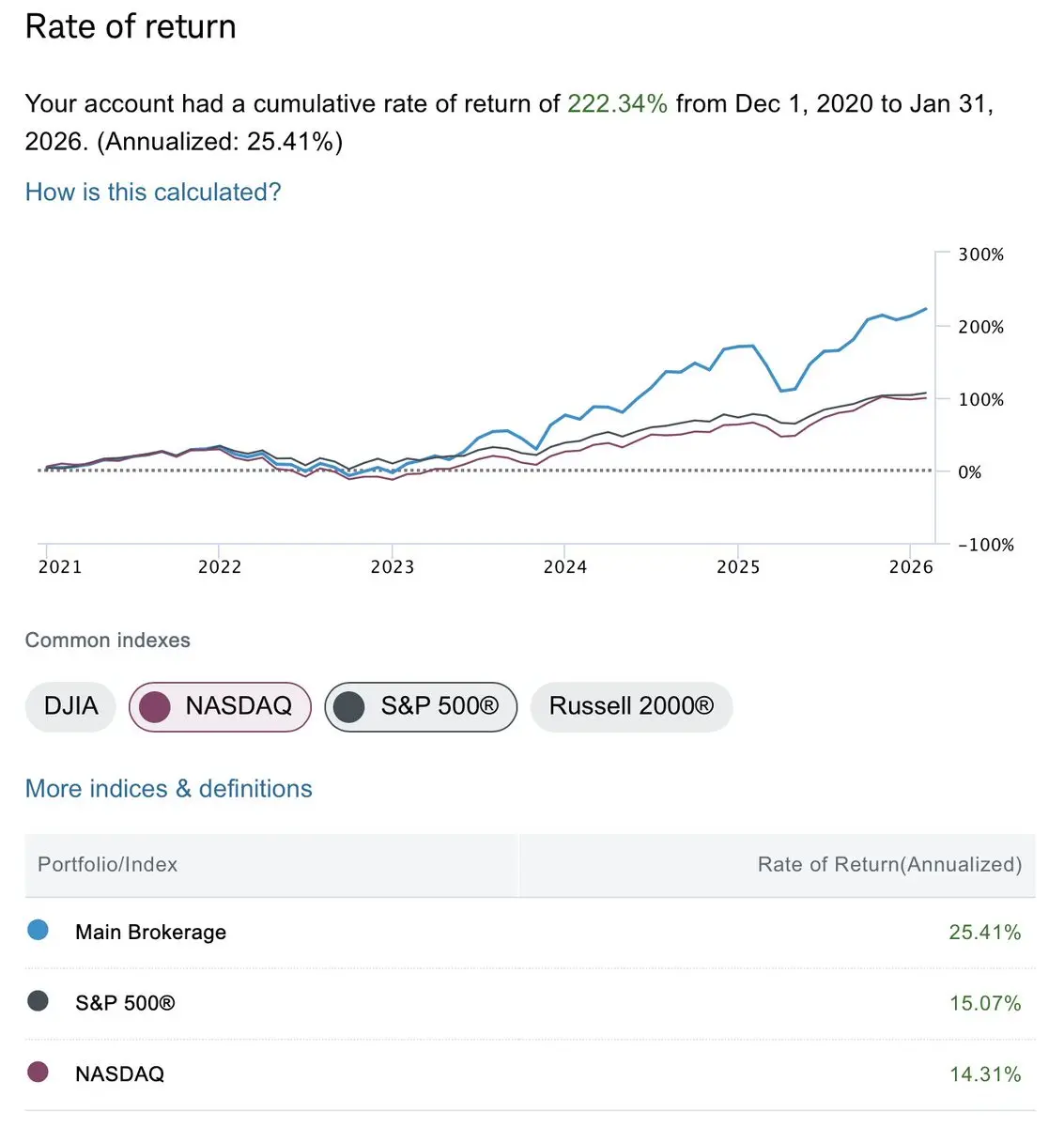

I have yet to see someone send me a legit ROI in the last 5 years (through bear market and bull market) that has beat the SP500 with the wheel.

Attached i

1. You sell cash secured puts (CSP suck)

2. You have a pile of cash sitting there doing nothing.

3. Selling puts is bullish, yet you have cash sitting there not working.

4. If you get assigned the shares (should be a great company at a good price if you truly were bullish selling the put) the strategy says to sell CCs.

5. Why would you wanna cap upside by selling CCs on something you are bullish on...

I have yet to see someone send me a legit ROI in the last 5 years (through bear market and bull market) that has beat the SP500 with the wheel.

Attached i

- Reward

- 1

- Comment

- Repost

- Share

The same emotional humans that are excited to see green today…

Are the same ones depressed and questioning everything on red days.

As I always say.

Keep emotions in check & don’t worry about day to day volatility.

This applies to green & red days.

Are the same ones depressed and questioning everything on red days.

As I always say.

Keep emotions in check & don’t worry about day to day volatility.

This applies to green & red days.

- Reward

- like

- Comment

- Repost

- Share

Trending Topics

View More42.47M Popularity

157.94K Popularity

119.56K Popularity

1.67M Popularity

518.86K Popularity

Pin