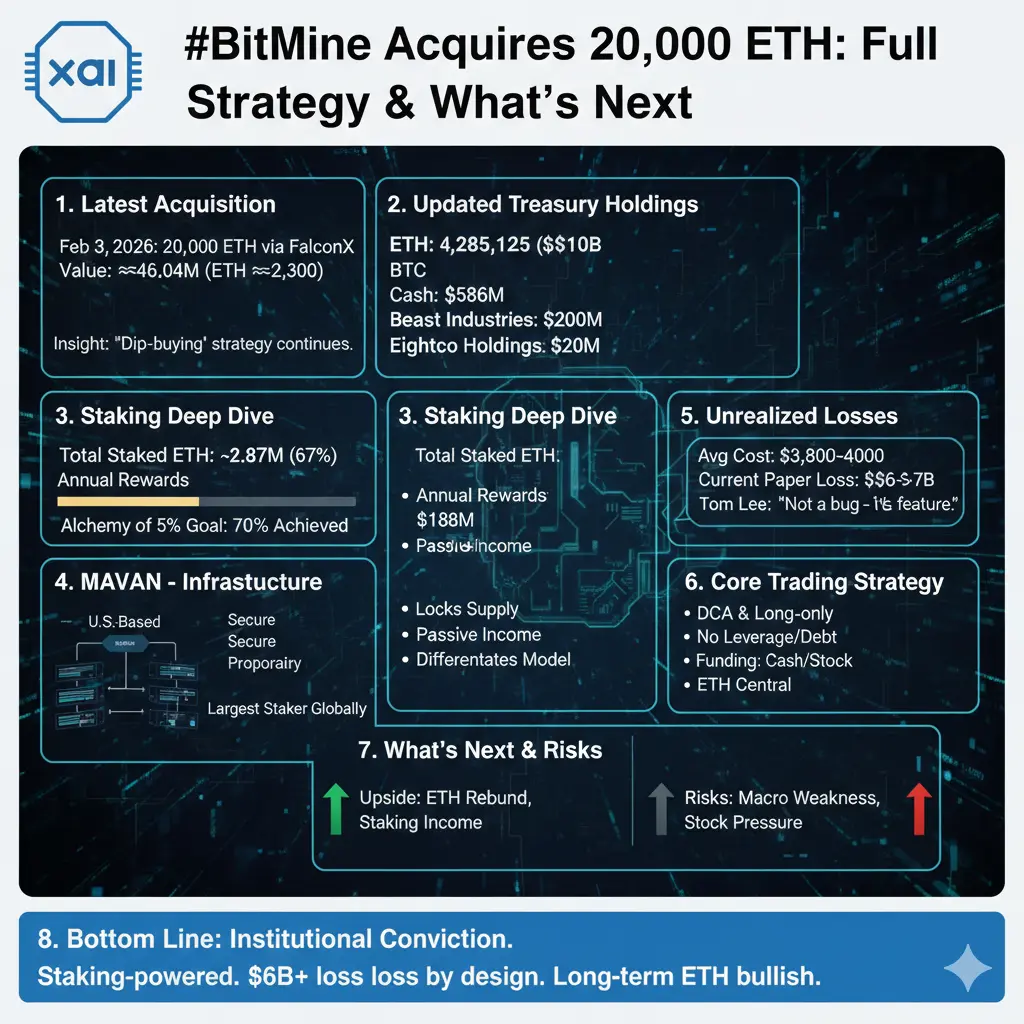

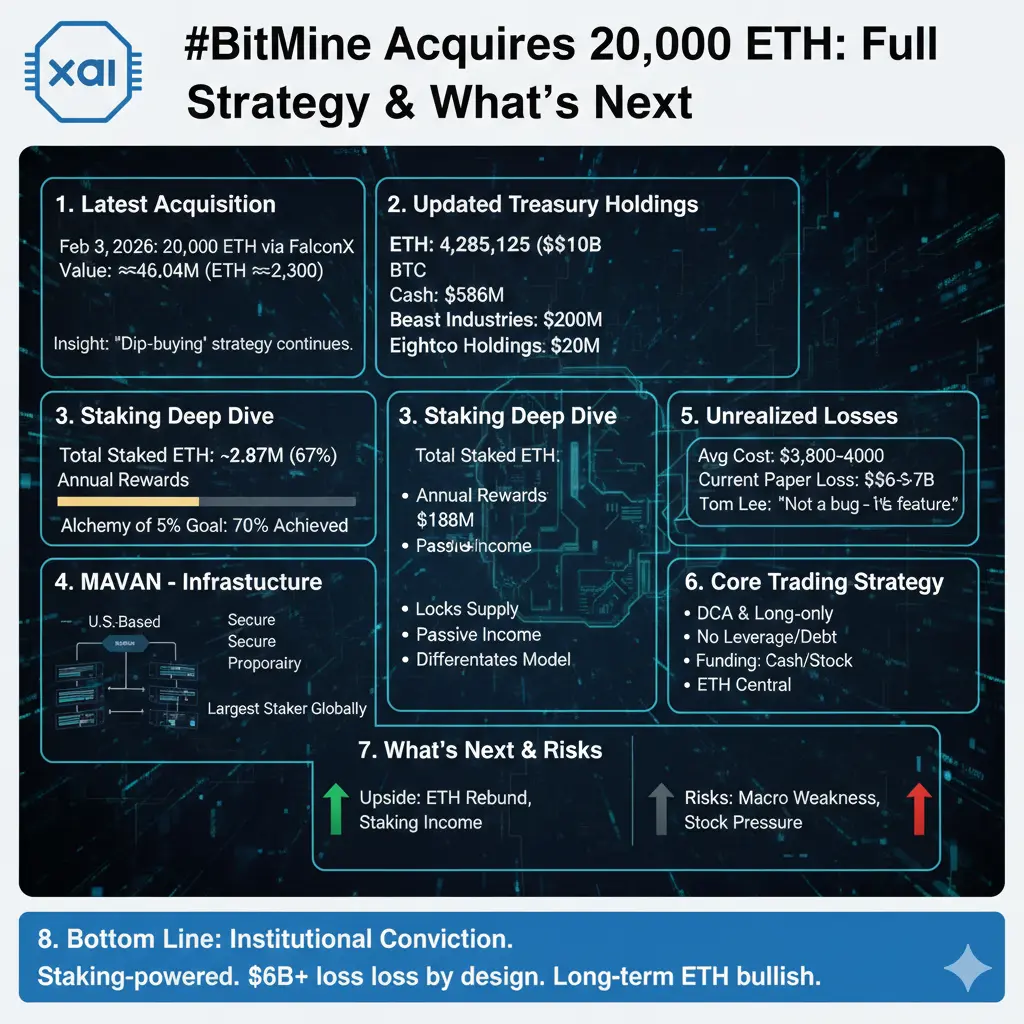

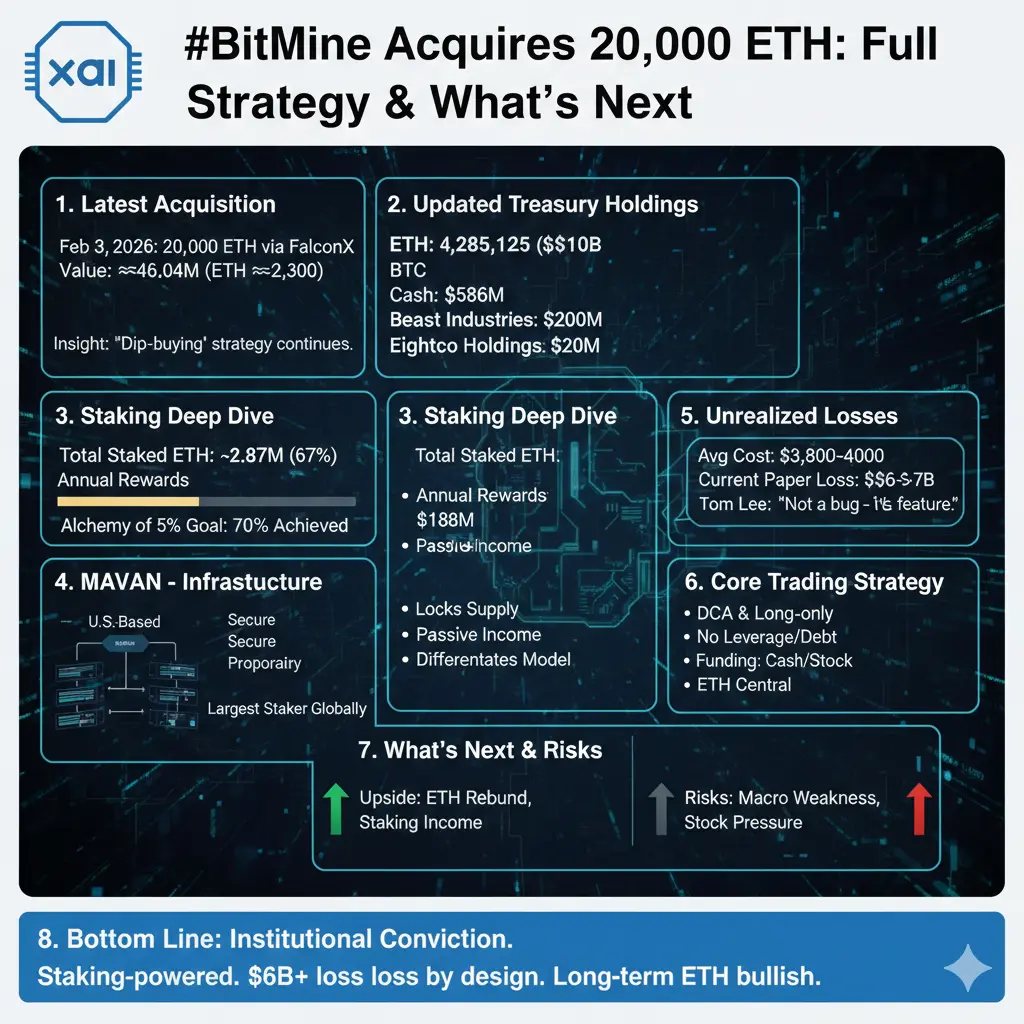

#BitMineAcquires20,000ETH BitMine’s 20,000 ETH Acquisition: Institutional Strategy, Staking Economics, and Ethereum’s Emergence as a Global Reserve Asset

Ethereum’s institutional era is no longer theoretical — it is now observable.

BitMine’s acquisition of 20,000 ETH represents a defining moment in Ethereum’s evolution as a financial asset. This transaction was not driven by short-term price movements or speculative sentiment. It reflects a deeper structural shift in how sophisticated capital views Ethereum: not as a volatile cryptocurrency, but as productive digital infrastructure capable of generating yield, securing decentralized systems, and anchoring long-term balance sheets.

This move highlights a broader transformation underway in global capital markets, where Ethereum is increasingly evaluated through the lens of capital efficiency, network utility, and strategic reserve value.

🏦 BitMine’s Treasury Strategy: Long-Duration Capital Allocation

As a digital asset treasury firm, BitMine operates under a fundamentally different mandate than retail traders or momentum-driven funds.

Its strategy emphasizes:

• Long-term holding

• Balance-sheet resilience

• Capital preservation

• Compounding returns

Within this framework, Ethereum naturally qualifies as a treasury-grade asset.

By accumulating ETH at scale, BitMine is signaling that Ethereum now belongs alongside long-term reserve instruments — assets held for years, not months, and intended to support future financial infrastructure.

📊 Institutional Execution: Structural, Not Speculative

The structure of the acquisition is as important as its size.

BitMine utilized institutional execution channels to minimize market impact, demonstrating:

• Advanced planning

• Strategic intent

• Capital discipline

This was not a reaction to market momentum. It was a deliberate deployment aligned with a broader accumulation thesis.

Such execution patterns are characteristic of entities that treat assets as foundations, not inventory.

🔁 Ethereum as Productive Capital: The Staking Advantage

Unlike traditional reserve assets, Ethereum offers native yield through staking.

This transforms ETH from passive exposure into productive capital.

For institutions, this provides:

• Reduced opportunity cost

• Income generation

• Long-term compounding

• Volatility smoothing

Ethereum becomes a hybrid instrument — part infrastructure asset, part yield-bearing reserve.

This structural advantage is central to its institutional appeal.

🌐 Infrastructure Exposure: Owning the Settlement Layer

Ethereum is not merely an asset — it is the settlement and execution layer for the digital economy.

It underpins:

• DeFi systems

• Stablecoin rails

• Tokenized securities

• Programmable finance

Holding ETH means owning the fuel that powers this expanding ecosystem.

As on-chain activity grows, demand for ETH as gas, collateral, and settlement medium increases structurally — independent of speculative cycles.

This positions ETH as infrastructure, not experimentation.

📈 Staking at Scale: A Compounding Engine

When institutions stake ETH at scale, they:

• Lock supply

• Earn protocol-native rewards

• Increase holdings organically

• Strengthen network security

This creates a self-reinforcing loop of accumulation and participation.

For treasury-focused firms, staking converts Ethereum from idle capital into a compounding financial engine.

⚖️ Supply Dynamics: Institutional Scarcity Effects

Large-scale institutional accumulation alters market structure.

When ETH is:

• Acquired at scale

• Committed to long-term holding

• Staked for yield

It is effectively removed from liquid circulation.

This reduces available supply and increases sensitivity to incremental demand.

Over time, price dynamics become more influenced by scarcity and usage than by speculative churn.

📡 Signaling Power: Institutional Legitimization

Institutional behavior shapes market perception.

When well-capitalized firms treat Ethereum as a reserve asset, it:

• Validates similar strategies

• Reduces perceived risk

• Encourages peer adoption

• Accelerates maturation

Asset classes evolve through repeated behavior, not isolated announcements.

BitMine’s action contributes to this cumulative institutional narrative.

🏗️ From Risk Asset to Financial Backbone

Ethereum’s narrative is shifting.

It is increasingly defined by:

• Reliability

• Economic throughput

• Network security

• Institutional participation

As staking deepens and treasury adoption expands, Ethereum begins to resemble foundational infrastructure rather than speculative technology.

BitMine’s acquisition reinforces this transition.

🔮 Long-Term Implications: Structural Capital Cycles

If Ethereum continues to be adopted as a treasury and staking asset, future cycles may be shaped by:

• Structured capital allocation

• Institutional balance-sheet strategy

• Infrastructure valuation models

ETH may increasingly be compared to sovereign or systemic assets rather than emerging tech.

In this context, BitMine’s allocation appears early — not aggressive.

🧭 A Statement of Intent, Not a Trade

This was not a tactical position.

It was a strategic declaration.

BitMine’s move reflects conviction in:

• Ethereum’s durability

• Its economic model

• Its security architecture

• Its role in global finance

As more institutions adopt similar approaches, Ethereum’s position as a digital reserve and settlement asset will continue to strengthen.

📍 Conclusion

The

#BitMineAcquires20,000ETH event is not the end of a story.

It is evidence that a much larger transformation is underway.

Ethereum is evolving from a speculative asset into productive, institutional-grade financial infrastructure.

BitMine’s acquisition is not a headline-driven trade.

It is a marker of where serious capital believes the future is headed.

And that future is increasingly being built on Ethereum