2025 SUSHI Price Prediction: Expert Analysis and Market Forecast for the Leading DeFi Token

Introduction: Market Position and Investment Value of SUSHI

SUSHI (SUSHI), a governance token within the SushiSwap decentralized exchange ecosystem, has emerged as a significant player in the decentralized finance sector since its inception in 2020. As of December 2025, SUSHI has established itself with a market capitalization of approximately $88.69 million and a circulating supply of around 273 million tokens, with the price currently trading near $0.3083. This governance-focused asset plays an increasingly important role in the SushiSwap protocol, where SUSHI token holders are entitled to share 0.05% of transaction fees once liquidity migration is completed.

This article will provide a comprehensive analysis of SUSHI's price trajectory and market dynamics through 2030, integrating historical price patterns, market supply-demand dynamics, ecosystem development, and macroeconomic factors to deliver professional price forecasts and practical investment strategies for crypto asset investors.

SUSHI Market Analysis Report

I. SUSHI Price History Review and Current Market Status

SUSHI Historical Price Evolution

- March 14, 2021: All-Time High (ATH) achieved at $23.38, representing the peak of market enthusiasm during the 2021 bull cycle.

- October 11, 2025: All-Time Low (ATL) reached at $0.254831, marking the lowest point in the token's trading history.

- 2020-2025: Long-term decline of -84.85% over one year, reflecting sustained downward pressure and decreased market interest.

SUSHI Current Market Situation

Price and Market Metrics (as of December 17, 2025 at 23:30:10 UTC):

SUSHI is currently trading at $0.3083, with a 24-hour trading volume of $130,258.92. The token exhibits moderate volatility in short-term timeframes, gaining 1.98% in the past hour and 3% over the last 24 hours. However, medium to long-term performance shows significant decline, with losses of -9.03% over 7 days, -33.43% over 30 days, and -84.85% over the past year.

The market capitalization stands at $84.17 million with a fully diluted valuation of $88.69 million. The circulating supply comprises 273.01 million SUSHI tokens out of a total supply of 287.68 million tokens, with unlimited maximum supply. The token maintains a market dominance of 0.0027%, ranking 384th by market capitalization among cryptocurrencies. Currently, 125,670 token holders are recorded, and SUSHI is actively traded on 53 different exchanges.

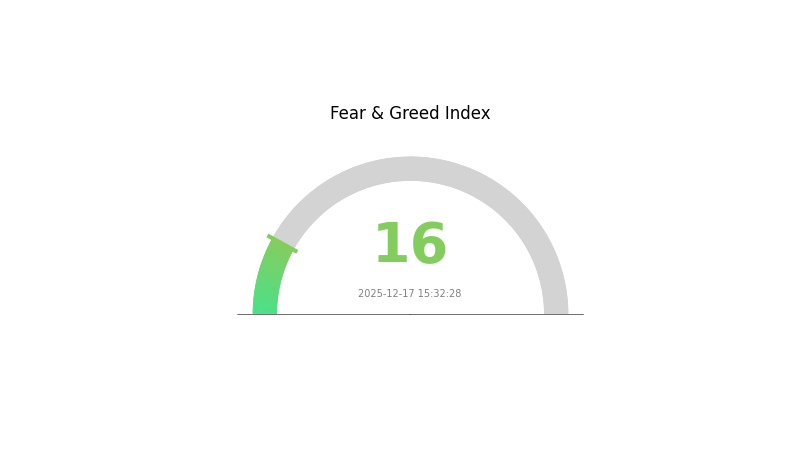

The 24-hour trading range oscillates between $0.2964 (low) and $0.3096 (high), indicating contained price movement within a narrow band. Market sentiment remains bearish, classified as "Extreme Fear" with a VIX indicator of 16.

Click to view current SUSHI market price

SUSHI Market Sentiment Indicator

2025-12-17 Fear and Greed Index: 16 (Extreme Fear)

Click to view the current Fear & Greed Index

The crypto market is currently experiencing extreme fear, with the Fear and Greed Index plummeting to 16. This indicates severe market pessimism and investor anxiety. During such periods, market volatility typically intensifies as participants rush to exit positions. However, extreme fear often creates contrarian opportunities for long-term investors. On Gate.com, you can monitor real-time market sentiment data to make informed trading decisions and identify potential market turning points during these high-fear environments.

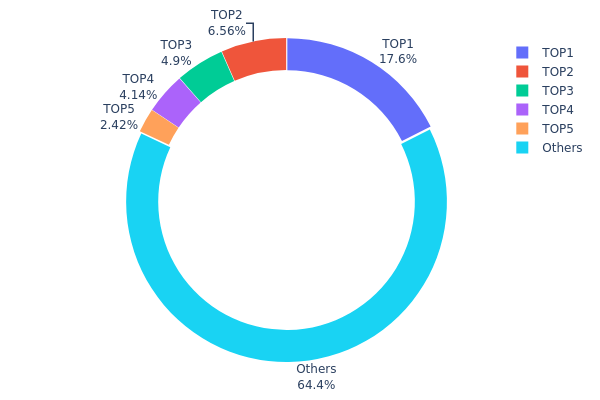

SUSHI Holdings Distribution

The address holdings distribution map illustrates the concentration of SUSHI tokens across blockchain addresses, revealing the decentralization characteristics and wealth distribution patterns of the token. By analyzing the top holders and the proportion of tokens held by each address, we can assess market concentration risk, potential price manipulation vulnerabilities, and the overall health of the token's on-chain ecosystem.

SUSHI currently exhibits moderate concentration characteristics. The top five addresses collectively control approximately 35.59% of total token supply, with the leading address (0xf977...41acec) accounting for 17.58% of holdings. While this concentration level warrants attention, it remains below the threshold of severe centralization. The remaining 64.41% of tokens distributed among other addresses indicates a reasonably fragmented holder base. However, the significant gap between the top holder and subsequent addresses suggests potential concentration risk, as large-scale liquidation or coordinated actions by major holders could influence market dynamics and create price volatility.

The current distribution structure presents both opportunities and challenges for market stability. The concentration in top addresses may amplify price fluctuations during periods of high volatility, particularly if major holders execute large transactions simultaneously. Conversely, the substantial proportion of tokens held by dispersed addresses (64.41%) provides a stabilizing effect, distributing decision-making power across numerous participants. This hybrid structure suggests SUSHI maintains a moderate level of decentralization, though continued monitoring of large holder movements remains essential for assessing long-term market structure sustainability and vulnerability to potential whale-driven manipulation.

Visit SUSHI Holdings Distribution on Gate.com for real-time data.

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xf977...41acec | 50595.32K | 17.58% |

| 2 | 0x8798...ff4272 | 18883.01K | 6.56% |

| 3 | 0x611f...dfb09d | 14107.51K | 4.90% |

| 4 | 0xa4b9...e1bf30 | 11905.45K | 4.13% |

| 5 | 0x5a52...70efcb | 6973.07K | 2.42% |

| - | Others | 185212.00K | 64.41% |

II. Core Factors Influencing SUSHI's Future Price

Supply Mechanism

- Inflation Rate: SUSHI's inflation rate continues to decline, which is expected to drive prices upward over the long term.

- Historical Performance: Historical supply changes and price fluctuations show a high correlation, with supply dynamics playing a significant role in price movement patterns.

Institutional and Whale Dynamics

- Whale Accumulation: Large-scale accumulation by institutional investors and whales may create upward pressure on token prices through increased demand, though long-term impacts will depend on broader market conditions and protocol performance.

Technology Development and Ecosystem Building

- User Adoption Trends: Technical development and user adoption trends serve as key factors influencing SUSHI's price movements, with growing ecosystem participation supporting long-term value proposition.

III. SUSHI Price Forecast for 2025-2030

2025 Outlook

- Conservative Forecast: $0.2209 - $0.2640

- Neutral Forecast: $0.2640 - $0.3068

- Optimistic Forecast: $0.3068 - $0.32828 (requires sustained DeFi ecosystem growth and increased protocol adoption)

2026-2027 Medium-term Outlook

- Market Phase Expectation: Gradual recovery phase with increasing adoption of SUSHI protocol services, supported by ecosystem expansion and strategic partnerships

- Price Range Predictions:

- 2026: $0.21593 - $0.4128

- 2027: $0.18989 - $0.44551

- Key Catalysts: Enhanced liquidity mining mechanisms, cross-chain integration improvements, institutional interest in decentralized finance protocols, and ecosystem governance developments

2028-2030 Long-term Outlook

- Base Case Scenario: $0.32022 - $0.4783 (assuming steady adoption of SushiSwap services and moderate market expansion)

- Optimistic Scenario: $0.41089 - $0.49484 (assuming accelerated DeFi adoption and successful protocol innovations)

- Transformative Scenario: $0.42149 - $0.63224 (extreme positive conditions including mainstream institutional adoption, major protocol breakthroughs, and sustained bull market momentum)

- 2030-12-31: SUSHI reaching $0.63224 (peak valuation scenario under optimal market conditions)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.32828 | 0.3068 | 0.2209 | 0 |

| 2026 | 0.4128 | 0.31754 | 0.21593 | 2 |

| 2027 | 0.44551 | 0.36517 | 0.18989 | 18 |

| 2028 | 0.4783 | 0.40534 | 0.32022 | 31 |

| 2029 | 0.49484 | 0.44182 | 0.41089 | 43 |

| 2030 | 0.63224 | 0.46833 | 0.42149 | 51 |

SUSHI Investment Strategy and Risk Management Report

IV. SUSHI Professional Investment Strategy and Risk Management

SUSHI Investment Methodology

(1) Long-term Holding Strategy

-

Target Investors: Cryptocurrency enthusiasts with medium to long-term investment horizons and moderate risk tolerance who believe in decentralized exchange governance models.

-

Operation Recommendations:

- Accumulate SUSHI during market downturns when prices are below $0.35, as the token has historical support levels.

- Set a diversified portfolio allocation where SUSHI represents no more than 5-10% of total crypto holdings due to its high volatility and -84.85% annual performance.

- Participate in community governance votes to understand token utility developments and potential future fee-sharing mechanisms.

-

Storage Solution:

- Transfer SUSHI to Gate Web3 Wallet for secure custody with self-custody benefits.

- Enable multi-signature verification for amounts exceeding $10,000 equivalent.

- Maintain backup seed phrases in secure, offline storage locations.

(2) Active Trading Strategy

-

Technical Analysis Tools:

- Support and Resistance Levels: Identify trading ranges around $0.30 (recent support) and $0.31 (24-hour high), with historical resistance at $0.35.

- Moving Averages: Use 20-day and 50-day moving averages to identify trend direction and potential reversal points.

-

Swing Trading Key Points:

- Monitor 24-hour volume levels (current: $130,258.92) for liquidity confirmation before entering positions.

- Utilize the -9.03% 7-day decline as a potential oversold indicator for contrarian positioning.

- Set stop-losses at 15-20% below entry points given the asset's high volatility profile.

SUSHI Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-2% portfolio allocation maximum, combined with dollar-cost averaging over 3-6 months.

- Active Investors: 3-5% portfolio allocation, with tactical entry points during 15%+ pullbacks.

- Professional Investors: 5-10% allocation with hedging strategies and derivative positions for volatility management.

(2) Risk Hedging Solutions

- Diversification Strategy: Balance SUSHI holdings with established cryptocurrencies and stablecoins to reduce concentrated risk exposure.

- Position Sizing: Never allocate more than 3% of total portfolio to SUSHI in a single transaction; scale in over multiple weeks.

(3) Secure Storage Solutions

- Web3 Wallet Recommendation: Gate Web3 Wallet provides institutional-grade security with user-controlled private keys for self-custody of SUSHI tokens on Ethereum.

- Cold Storage Approach: For holdings exceeding $50,000 equivalent, maintain 80% in cold storage solutions with only 20% in hot wallets for active trading.

- Security Precautions: Never share private keys or seed phrases; use hardware-backed authentication methods; enable withdrawal whitelist features on Gate.com for exchange-based holdings.

V. SUSHI Potential Risks and Challenges

SUSHI Market Risks

- Severe Price Depreciation: SUSHI has declined 84.85% over the past year and 33.43% in the past month, indicating sustained downward pressure and potential further losses for long-term holders.

- Liquidity Concerns: With 24-hour trading volume of only $130,258.92 against a market cap of $84.17 million, the token faces liquidity challenges that could result in slippage during large transactions.

- Low Market Dominance: At 0.0027% market dominance, SUSHI lacks sufficient market influence and institutional support compared to major DeFi tokens.

SUSHI Regulatory Risks

- Decentralized Exchange Regulatory Uncertainty: Global regulators are increasingly scrutinizing DeFi platforms and governance tokens, which could impact SUSHI's legal status and trading availability across jurisdictions.

- Securities Classification Risk: Governance tokens like SUSHI face potential reclassification as securities, which could restrict trading and holding in certain regulatory environments.

- Compliance Burden Escalation: Enhanced compliance requirements for decentralized exchanges may increase operational costs and reduce profitability sharing for token holders.

SUSHI Technical Risks

- Smart Contract Vulnerabilities: As a governance token tied to decentralized exchange protocols, SUSHI remains exposed to potential smart contract exploits or security vulnerabilities.

- Protocol Obsolescence: The emergence of more advanced DEX models and competing platforms could reduce SushiSwap's relevance and trading volume, diminishing SUSHI token value.

- Chain Dependency: SUSHI's primary deployment on Ethereum exposes it to network congestion and increasing gas fees, which may impact protocol competitiveness.

VI. Conclusion and Action Recommendations

SUSHI Investment Value Assessment

SUSHI represents a speculative governance token for a mature but challenged decentralized exchange platform. With an all-time high of $23.38 (March 2021) and current price of $0.3083, the token has lost over 98.7% of its peak value. While SushiSwap maintains 125,670 token holders and integration with Gate.com for trading access, the fundamentals show weak market momentum (3% 24-hour gain cannot offset -84.85% annual decline), limited liquidity, and uncertain value proposition beyond governance rights. The lack of active development announcements and declining market relevance make SUSHI a high-risk holding suitable only for speculative investors with substantial risk tolerance.

SUSHI Investment Recommendations

✅ Beginners: Avoid SUSHI as a primary holding; use no more than 1% of portfolio for learning governance mechanisms. Consider starting with larger-cap DeFi tokens with proven track records.

✅ Experienced Investors: Deploy tactical positions only during extreme oversold conditions (>20% weekly decline) with strict 15% stop-losses. Allocate maximum 3-5% as a speculative position within diversified portfolio.

✅ Institutional Investors: Conduct thorough due diligence on SushiSwap protocol developments and governance evolution before consideration. If investing, use only small positions (1-2%) combined with comprehensive hedging strategies.

SUSHI Trading Participation Methods

- Exchange Trading: Trade SUSHI on Gate.com with competitive spreads and institutional-grade order matching against BTC, ETH, and USDT pairs.

- Staking and Governance: Participate in SushiSwap's governance mechanisms to understand protocol development and potential future revenue-sharing mechanisms for token holders.

- Portfolio Diversification Entry: Use SUSHI as a satellite position within diversified DeFi/governance token allocations rather than as a core holding.

Cryptocurrency investments carry extreme risk. This report does not constitute investment advice. Investors should make decisions based on their personal risk tolerance and financial situation. Consult professional financial advisors before investing. Never invest more capital than you can afford to lose completely.

FAQ

Does SUSHI crypto have a future?

Yes, SUSHI has a promising future. With strong community backing, innovative DeFi features, and growing adoption in decentralized finance, SUSHI is positioned for continued development and potential value appreciation in the expanding crypto ecosystem.

Will SUSHI prices go up?

Yes, SUSHI prices are expected to rise. Increasing trading activity, growing ecosystem adoption, and strong community support suggest bullish momentum ahead.

What is the all time high of SUSHI coin?

The all-time high of SUSHI coin is $23.25, which was reached before December 2025. This represents the peak price level the token has achieved since its inception.

Is SushiSwap a buy?

SushiSwap shows bearish signals with declining price momentum. Current technical analysis suggests a downtrend, with forecasts indicating potential 53% decline over three months. Strong sell signals from moving averages suggest caution for buyers at current levels.

XZXX: A Comprehensive Guide to the BRC-20 Meme Token in 2025

Bitcoin Fear and Greed Index: Market Sentiment Analysis for 2025

Top Crypto ETFs to Watch in 2025: Navigating the Digital Asset Boom

5 ways to get Bitcoin for free in 2025: Newbie Guide

Bitcoin Market Cap in 2025: Analysis and Trends for Investors

2025 Bitcoin Price Prediction: Trump's Tariffs' Impact on BTC

What is GIGGLE: A Comprehensive Guide to Understanding This Emerging Technology Platform

What is RECALL: A Comprehensive Guide to Understanding Information Retrieval and Memory Performance Metrics

What is ESPORTS: A Comprehensive Guide to Professional Gaming and Competitive Video Gaming Industry

What is LRC: A Complete Guide to Lyric Synchronization Format

2025 PIEVERSE Price Prediction: Expert Analysis and Market Forecast for the Next Year