2025 ZERO Price Prediction: Analyzing Market Trends and Potential Growth Factors

Introduction: ZERO's Market Position and Investment Value

ZERO (ZERO), as the first token of the first meta protocol on Solana, has established itself as a unique asset since its inception. As of 2025, ZERO's market capitalization has reached $2,439,150, with a circulating supply of 21,000,000 tokens, and a price hovering around $0.11615. This asset, known as the "Index Protocol Pioneer," is playing an increasingly crucial role in the Solana ecosystem and decentralized finance.

This article will comprehensively analyze ZERO's price trends from 2025 to 2030, considering historical patterns, market supply and demand, ecosystem development, and macroeconomic factors, to provide investors with professional price predictions and practical investment strategies.

I. ZERO Price History Review and Current Market Status

ZERO Historical Price Evolution

- 2023: Initial public minting through block auction war, price peaked at $2.5 on December 27

- 2024: Market fluctuations, price experienced volatility

- 2025: Bearish market cycle, price dropped from its all-time high to a low of $0.05671 on April 7

ZERO Current Market Situation

As of October 15, 2025, ZERO is trading at $0.11615, representing a 95.35% decrease from its all-time high. The token has shown negative performance across various timeframes, with a 24-hour decline of 3.12%, a 7-day drop of 10.95%, and a 30-day decrease of 19.34%. The current market capitalization stands at $2,439,150, with a circulating supply of 21,000,000 ZERO tokens. The 24-hour trading volume is $15,368.92, indicating moderate market activity. Despite the overall bearish trend, ZERO has shown some resilience by maintaining a price above its all-time low, suggesting potential support at current levels.

Click to view the current ZERO market price

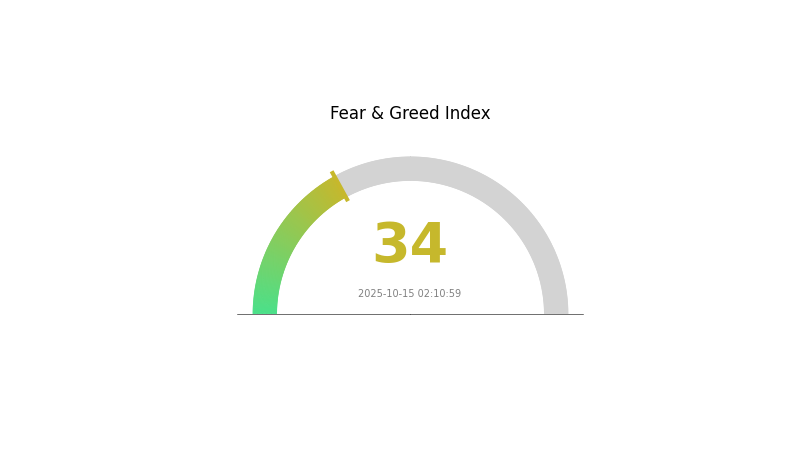

ZERO Market Sentiment Indicator

2025-10-15 Fear and Greed Index: 34 (Fear)

Click to view the current Fear & Greed Index

The cryptocurrency market is currently experiencing a period of fear, with the Fear and Greed Index standing at 34. This suggests that investors are cautious and uncertain about market conditions. During such times, it's crucial to remain level-headed and avoid making impulsive decisions. Some investors view fear in the market as a potential buying opportunity, following the adage "be greedy when others are fearful." However, it's essential to conduct thorough research and consider your risk tolerance before making any investment decisions.

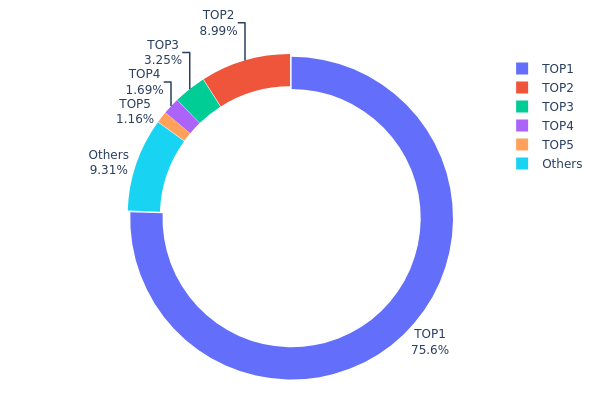

ZERO Holdings Distribution

The address holdings distribution data for ZERO reveals a highly concentrated ownership structure. The top address holds a staggering 75.59% of the total supply, amounting to 15,874.21K tokens. This extreme concentration raises significant concerns about the token's decentralization and market stability.

The second-largest holder possesses 8.99% of the supply, while the remaining top 5 addresses collectively control about 6% of ZERO tokens. This leaves only 9.34% distributed among all other addresses. Such a skewed distribution pattern indicates a potential risk of market manipulation and high volatility, as large holders could significantly impact the token's price through their trading activities.

This concentration level suggests that ZERO's on-chain structure is currently unstable and vulnerable to centralized decision-making. It may deter smaller investors due to perceived risks and could hinder the project's long-term sustainability and adoption. Monitoring changes in this distribution will be crucial for assessing ZERO's progress towards a more balanced and decentralized ecosystem.

Click to view the current ZERO Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 6G1nWW...3yeCt9 | 15874.21K | 75.59% |

| 2 | A77HEr...oZ4RiR | 1888.80K | 8.99% |

| 3 | u6PJ8D...ynXq2w | 681.86K | 3.24% |

| 4 | 8a93T1...gCJSYE | 355.00K | 1.69% |

| 5 | HugT8T...KkXM6y | 243.31K | 1.15% |

| - | Others | 1955.99K | 9.34% |

II. Key Factors Influencing ZERO's Future Price

Supply Mechanism

- Halving: The supply of ZERO is reduced by half every four years, creating scarcity and potentially driving up the price.

- Historical Pattern: Previous halvings have led to significant price increases in the long term.

- Current Impact: The upcoming halving is expected to reduce supply and potentially increase demand, which could drive up the price.

Institutional and Whale Dynamics

- Institutional Holdings: Major financial institutions are increasingly adding ZERO to their portfolios, indicating growing mainstream adoption.

- Corporate Adoption: Some notable companies have begun using ZERO as a treasury asset or for transactions.

- Government Policies: Regulatory clarity in some countries has encouraged institutional investment in ZERO.

Macroeconomic Environment

- Monetary Policy Impact: Central banks' policies on interest rates and quantitative easing can affect ZERO's attractiveness as an investment.

- Inflation Hedging Properties: ZERO is increasingly viewed as a hedge against inflation, similar to gold.

- Geopolitical Factors: Global economic uncertainties and geopolitical tensions can drive investors towards ZERO as a safe-haven asset.

Technological Development and Ecosystem Building

- Layer 2 Solutions: The implementation of Layer 2 scaling solutions is improving transaction speed and reducing fees.

- Smart Contract Upgrades: Enhancements to smart contract functionality are expanding ZERO's use cases.

- Ecosystem Applications: The growing number of DApps and projects built on ZERO's blockchain is increasing its utility and demand.

III. ZERO Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.0813 - $0.10

- Neutral prediction: $0.10 - $0.115

- Optimistic prediction: $0.115 - $0.12311 (requires favorable market conditions)

2027-2028 Outlook

- Market stage expectation: Potential growth phase

- Price range forecast:

- 2027: $0.13202 - $0.20767

- 2028: $0.14952 - $0.2225

- Key catalysts: Increased adoption and technological advancements

2029-2030 Long-term Outlook

- Base scenario: $0.20025 - $0.23329 (assuming steady market growth)

- Optimistic scenario: $0.26633 - $0.31961 (assuming strong market performance)

- Transformative scenario: $0.31961+ (extreme favorable conditions)

- 2030-12-31: ZERO $0.31961 (potential peak based on optimistic projections)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.12311 | 0.11614 | 0.0813 | 0 |

| 2026 | 0.17704 | 0.11962 | 0.08374 | 2 |

| 2027 | 0.20767 | 0.14833 | 0.13202 | 27 |

| 2028 | 0.2225 | 0.178 | 0.14952 | 53 |

| 2029 | 0.26633 | 0.20025 | 0.11014 | 72 |

| 2030 | 0.31961 | 0.23329 | 0.13531 | 100 |

IV. Professional Investment Strategies and Risk Management for ZERO

ZERO Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Risk-tolerant investors with a long-term perspective

- Operation suggestions:

- Accumulate ZERO tokens during market dips

- Set a target holding period of at least 2-3 years

- Store tokens in a secure non-custodial wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential reversal points

- Relative Strength Index (RSI): Gauge overbought/oversold conditions

- Key points for swing trading:

- Monitor Solana ecosystem developments closely

- Set strict stop-loss orders to manage downside risk

ZERO Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple Solana ecosystem projects

- Use of stablecoins: Maintain a portion of portfolio in stablecoins for quick rebalancing

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Hardware wallet compatible with Solana tokens

- Security precautions: Enable two-factor authentication, use unique strong passwords

V. Potential Risks and Challenges for ZERO

ZERO Market Risks

- High volatility: Price fluctuations can be extreme in the short term

- Limited liquidity: May face challenges in executing large trades without significant slippage

- Dependency on Solana ecosystem: Performance tied to overall Solana adoption and growth

ZERO Regulatory Risks

- Uncertain regulatory environment: Potential for increased scrutiny of DeFi projects

- Cross-border compliance: Varying regulations across jurisdictions may impact global adoption

- Tax implications: Evolving tax laws may affect ZERO holders and traders

ZERO Technical Risks

- Smart contract vulnerabilities: Potential for exploits in the underlying protocol

- Scalability challenges: Dependent on Solana's ability to maintain high performance

- Interoperability issues: Limitations in cross-chain functionality may hinder growth

VI. Conclusion and Action Recommendations

ZERO Investment Value Assessment

ZERO presents a high-risk, high-potential opportunity within the Solana ecosystem. Long-term value proposition is tied to the success of the Index protocol, while short-term risks include market volatility and regulatory uncertainties.

ZERO Investment Recommendations

✅ Beginners: Consider small, educational positions to understand the Solana ecosystem ✅ Experienced investors: Implement a dollar-cost averaging strategy with strict risk management ✅ Institutional investors: Conduct thorough due diligence and consider as part of a diversified Solana ecosystem portfolio

ZERO Trading Participation Methods

- Spot trading: Available on Gate.com for direct token purchases

- Staking: Explore potential staking options if offered by the protocol

- Yield farming: Participate in liquidity provision if available, considering impermanent loss risks

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is the price prediction for zero token?

Zero token is expected to trade between $0.01902 and $0.064412 in 2025, with a neutral market sentiment.

Would hamster kombat coin reach $1?

Based on current projections, Hamster Kombat coin is unlikely to reach $1 by 2025. Predictions suggest an average price of around $0.02 in 2024, still far from the $1 mark.

What is the prediction for Zerebro?

Zerebro is predicted to potentially gain 20.15% in 2025. Traders often use moving averages to analyze price trends and make predictions for future performance.

Will LayerZero go up?

LayerZero's price is likely to increase. Analysts project substantial growth by 2030, with current market trends supporting this positive outlook.

2025 PYTH Price Prediction: Analyzing Market Trends and Growth Potential in the Oracle Protocol Ecosystem

2025 ZBCN Price Prediction: Navigating Market Trends and Future Valuation Analysis

How Can On-Chain Data Analysis Reveal Crypto Whales' Movements?

2025 SOL Price Prediction: Bullish Outlook as Solana Ecosystem Expands

2025 ZBCN Price Prediction: Analyzing Market Trends and Potential Growth Factors

How Does ORE's Fundamentals Analysis Impact Its Investment Potential in 2025?

Bitcoin Lifestyle

Is Trading with Leverage Haram?

Crypto Ice Mining

ETF vs Index Fund: Key Differences and How to Choose in 2026

What Is Bitcoin Power Law? Model, Chart & Calculator Guide