2025 LTCPrice Prediction: Analyzing Market Trends and Potential Growth Factors for Litecoin

Introduction: LTC's Market Position and Investment Value

Litecoin (LTC), as one of the earliest and most established altcoins, has achieved significant milestones since its inception in 2011. As of 2025, Litecoin's market capitalization has reached $8.68 billion, with a circulating supply of approximately 76.28 million coins, and a price hovering around $113.77. This asset, often referred to as "digital silver," is playing an increasingly crucial role in facilitating fast and low-cost transactions in the cryptocurrency ecosystem.

This article will provide a comprehensive analysis of Litecoin's price trends from 2025 to 2030, considering historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to offer professional price predictions and practical investment strategies for investors.

I. LTC Price History Review and Current Market Status

LTC Historical Price Evolution Trajectory

- 2011: Litecoin launched, initial price around $4.3

- 2013: First major bull run, price reached $50

- 2017: Cryptocurrency boom, LTC hit all-time high of $375

- 2018: Market crash, price dropped to $23

- 2021: Another bull market, LTC peaked at $410.26 on May 10

LTC Current Market Situation

As of September 9, 2025, Litecoin (LTC) is trading at $113.77. The cryptocurrency has shown resilience in the market, maintaining its position as the 26th largest by market capitalization. LTC's current market cap stands at $8.68 billion, with a circulating supply of 76,277,864 LTC.

In the past 24 hours, LTC has seen a modest gain of 0.41%, with a trading volume of $5,758,075. The coin has experienced a slight dip of 0.03% in the last hour but shows stronger performance over the past week with a 2.79% increase. However, the 30-day trend indicates a decline of 5.89%.

LTC's current price is significantly below its all-time high of $410.26, recorded on May 10, 2021. The coin has maintained substantial growth over the past year, with an impressive 87.03% increase, showcasing its long-term potential despite short-term fluctuations.

Click to view the current LTC market price

LTC Market Sentiment Indicator

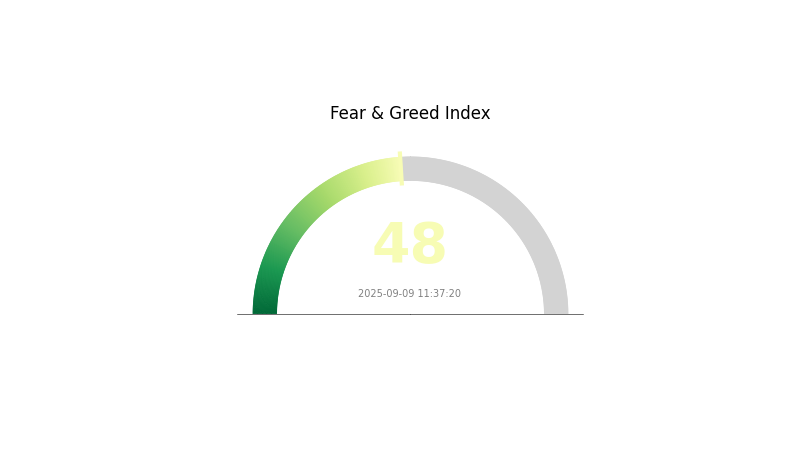

2025-09-09 Fear and Greed Index: 48 (Neutral)

Click to view the current Fear & Greed Index

The cryptocurrency market sentiment for Litecoin (LTC) is currently in a neutral state, with the Fear and Greed Index at 48. This indicates a balanced mood among investors, suggesting neither extreme fear nor excessive optimism. Traders should remain cautious and vigilant, as the market could potentially swing in either direction. It's advisable to conduct thorough research and analysis before making any investment decisions. Keep an eye on key LTC indicators and global market trends to navigate this neutral landscape effectively.

LTC Holdings Distribution

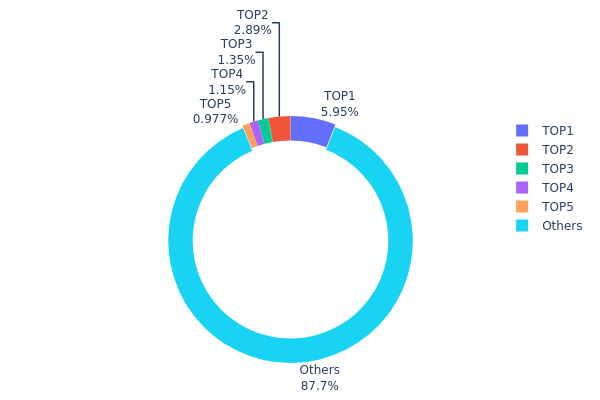

The address holdings distribution data provides valuable insights into the concentration of Litecoin (LTC) ownership. The top 5 addresses collectively hold 12.3% of the total LTC supply, with the largest address containing 5.94% of all coins. This indicates a moderate level of concentration, but not to an extent that raises immediate concerns about market manipulation.

The distribution pattern suggests a relatively healthy balance between large holders and smaller participants. With 87.7% of LTC spread among numerous other addresses, it demonstrates a significant degree of decentralization. This diversification can contribute to market stability and resilience against potential price manipulation attempts by individual large holders.

However, the presence of a few addresses with substantial holdings warrants attention. These major stakeholders could potentially influence market dynamics if they decide to make large transactions. Overall, the current LTC address distribution reflects a maturing market with a good balance between institutional interest and widespread adoption among retail investors.

Click to view the current LTC Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | MQd1fJ...qDbPQS | 4537.51K | 5.94% |

| 2 | ltc1qr...h5pp4t | 2205.01K | 2.89% |

| 3 | MLj1bg...nXXV3E | 1033.08K | 1.35% |

| 4 | MS56eJ...pTzZ5V | 878.22K | 1.15% |

| 5 | MQSs17...K5iCB6 | 745.00K | 0.97% |

| - | Others | 66880.47K | 87.7% |

II. Key Factors Affecting LTC's Future Price

Supply Mechanism

- Halving: LTC undergoes halving events, reducing block rewards by 50%

- Historical Pattern: Previous halvings have led to price increases

- Current Impact: The 2023 halving reduced inflation rate, potentially driving up price

Institutional and Whale Dynamics

- Institutional Holdings: LTC "whales" now hold about 15.4% of total supply, the highest in over five years

- Corporate Adoption: Increasing number of merchants and online platforms accepting LTC payments

- National Policies: Global regulatory changes may impact LTC's operations

Macroeconomic Environment

- Monetary Policy Impact: Central bank policies and interest rate decisions may affect LTC price

- Inflation Hedging Properties: LTC viewed as a potential hedge against inflation

Technical Development and Ecosystem Building

- MimbleWimble Extension Blocks (MWEB): Enhances privacy and fungibility of LTC transactions

- Lightning Network: Enables faster and cheaper microtransactions, improving LTC's utility

- Ecosystem Applications: Growing use in cross-border and small-value payments

III. LTC Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $67.07 - $100

- Neutral prediction: $100 - $114

- Optimistic prediction: $114 - $123.90 (requires sustained market recovery and increased LTC adoption)

2027-2028 Outlook

- Market stage expectation: Potential consolidation phase followed by gradual growth

- Price range forecast:

- 2027: $110.80 - $130.95

- 2028: $88.62 - $152.83

- Key catalysts: Technological upgrades, wider merchant acceptance, and integration into DeFi ecosystems

2029-2030 Long-term Outlook

- Base scenario: $140 - $165 (assuming steady cryptocurrency market growth)

- Optimistic scenario: $165 - $200 (assuming strong bull market and increased LTC utility)

- Transformative scenario: $200 - $223.08 (assuming major breakthroughs in scalability and adoption)

- 2030-12-31: LTC $165.24 (potential year-end average price)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 123.9 | 113.67 | 67.0653 | 0 |

| 2026 | 133.04 | 118.79 | 77.21035 | 4 |

| 2027 | 130.95 | 125.91 | 110.8 | 10 |

| 2028 | 152.83 | 128.43 | 88.61705 | 12 |

| 2029 | 189.85 | 140.63 | 135.01 | 23 |

| 2030 | 223.08 | 165.24 | 102.45 | 45 |

IV. LTC Professional Investment Strategies and Risk Management

LTC Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Long-term investors, crypto enthusiasts

- Operation suggestions:

- Accumulate LTC during market dips

- Set up recurring purchases to average out price fluctuations

- Store LTC in a secure hardware wallet or reputable custodial service

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trend direction and potential reversals

- Relative Strength Index (RSI): Helps determine overbought or oversold conditions

- Key points for swing trading:

- Monitor LTC's correlation with Bitcoin's price movements

- Pay attention to halving events and their potential impact on price

LTC Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of portfolio

- Moderate investors: 5-10% of portfolio

- Aggressive investors: 15-20% of portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple cryptocurrencies and traditional assets

- Stop-loss orders: Set predetermined exit points to limit potential losses

(3) Secure Storage Solutions

- Hardware wallet recommendation: Gate Web3 wallet

- Cold storage option: Paper wallet for long-term hodling

- Security precautions: Enable two-factor authentication, use strong passwords, and keep private keys offline

V. Potential Risks and Challenges for LTC

LTC Market Risks

- High volatility: LTC price can experience significant fluctuations

- Competition: Emergence of new cryptocurrencies may impact LTC's market share

- Market sentiment: Negative news or events can quickly affect LTC's price

LTC Regulatory Risks

- Uncertain regulatory landscape: Changes in government policies may impact LTC's adoption and use

- Tax implications: Evolving tax laws may affect LTC investors and traders

- AML/KYC requirements: Stricter regulations may limit LTC's fungibility and privacy features

LTC Technical Risks

- Network attacks: Potential 51% attacks or other security vulnerabilities

- Scalability challenges: Future growth may strain the network's capacity

- Development stagnation: Lack of continuous improvement may lead to obsolescence

VI. Conclusion and Action Recommendations

LTC Investment Value Assessment

Litecoin offers faster transaction speeds and lower fees compared to Bitcoin, positioning it as a potential digital payment solution. However, investors should be aware of short-term volatility and potential regulatory challenges.

LTC Investment Recommendations

✅ Beginners: Start with small, regular investments to understand the market ✅ Experienced investors: Consider a mix of long-term holding and active trading strategies ✅ Institutional investors: Evaluate LTC as part of a diversified crypto portfolio

LTC Trading Participation Methods

- Spot trading: Buy and sell LTC on reputable exchanges like Gate.com

- Futures trading: Engage in leveraged trading for experienced investors

- Staking: Explore LTC staking options for passive income generation

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Will Litecoin reach $1000?

While Litecoin's price may reach $197.45 by 2025, hitting $1000 is uncertain. Future projections depend on market conditions and cryptocurrency trends.

Is LTC a good investment?

LTC's longevity, strong security, and low transaction fees make it a viable investment option. Its established presence in the digital asset market supports its potential.

What is the future of the LTC coin?

LTC's future looks promising with potential for price growth, increased adoption, and technological advancements. It may continue to be a popular alternative to Bitcoin.

Why is Litecoin so low?

Litecoin's price is low due to market downturns, regulatory issues, and project-specific challenges. Overall crypto market volatility also contributes to its current valuation.

Share

Content