2025 LCAT Price Prediction: Analyzing Potential Growth and Market Trends for the Emerging Cryptocurrency

Introduction: LCAT's Market Position and Investment Value

Lion Cat (LCAT), as a groundbreaking meme token on the Binance Smart Chain, has made significant strides since its inception. As of 2025, LCAT's market capitalization has reached $4,509,537, with a circulating supply of approximately 494,250,000 tokens, and a price hovering around $0.009124. This asset, dubbed the "AI-powered meme token," is playing an increasingly crucial role in the fields of cryptocurrency trading and AI-powered tools for crypto enthusiasts.

This article will comprehensively analyze LCAT's price trends from 2025 to 2030, considering historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to provide investors with professional price predictions and practical investment strategies.

I. LCAT Price History Review and Current Market Status

LCAT Historical Price Evolution

- 2025 (February): All-time high of $0.12806, marking the peak of LCAT's price trajectory

- 2025 (September): LCAT reached its all-time low of $0.00703, indicating a significant market correction

- 2025 (October): Current price recovery phase, with LCAT trading at $0.009124

LCAT Current Market Situation

As of October 12, 2025, LCAT is trading at $0.009124, showing a 24-hour gain of 2.46%. The token's market capitalization stands at $4,509,537, ranking it at 1789 in the global cryptocurrency market. LCAT has experienced a significant decline from its all-time high, with a -90.52% change over the past year. However, recent short-term performance shows signs of recovery, with a 2.46% increase in the last 24 hours. The token's trading volume in the past 24 hours is $35,329.195163, indicating moderate market activity. With a circulating supply of 494,250,000 LCAT out of a total supply of 600,000,000, the token has a circulation ratio of 82.375%.

Click to view the current LCAT market price

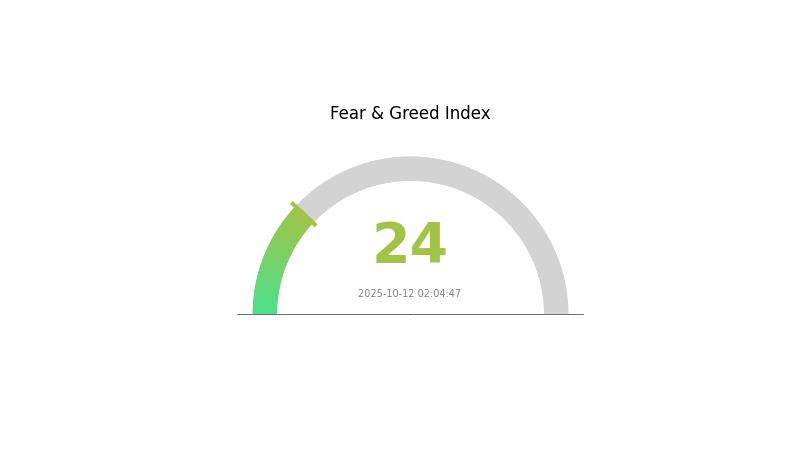

LCAT Market Sentiment Indicator

2025-10-12 Fear and Greed Index: 24 (Extreme Fear)

Click to view the current Fear & Greed Index

The crypto market is gripped by extreme fear today, with the sentiment index plummeting to 24. This level of pessimism often signals a potential buying opportunity for contrarian investors. However, caution is advised as market volatility may persist. Traders should consider dollar-cost averaging and thorough research before making any moves. Remember, market cycles are natural, and extreme sentiment levels rarely last long. Stay informed and manage your risk wisely in these uncertain times.

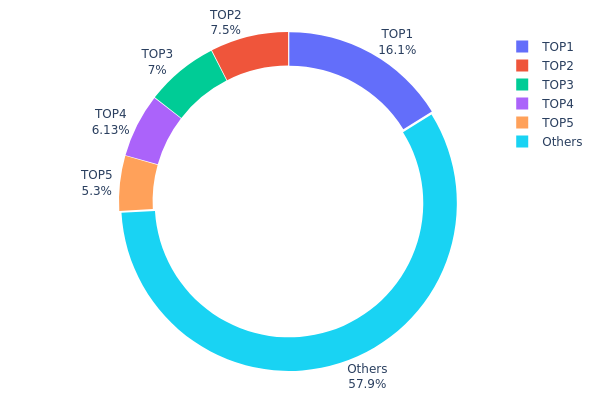

LCAT Holdings Distribution

The address holdings distribution data provides crucial insights into the concentration of LCAT tokens among different wallet addresses. Analysis of this data reveals a moderately concentrated distribution pattern. The top address holds 16.14% of the total supply, while the top five addresses collectively control 42.06% of LCAT tokens. This level of concentration, while significant, does not indicate extreme centralization.

The current distribution structure suggests a balanced market with potential for price stability. However, the substantial holdings of the top addresses could still influence market dynamics. The presence of 57.94% of tokens distributed among other addresses indicates a degree of decentralization, which may help mitigate the risk of market manipulation by a single entity.

Overall, the LCAT token distribution reflects a market with moderate centralization. This structure likely contributes to a relatively stable on-chain ecosystem, balancing between the influence of major holders and wider token dispersion among smaller participants.

Click to view the current LCAT Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xe27d...825cfc | 96870.83K | 16.14% |

| 2 | 0xd277...545833 | 45000.00K | 7.50% |

| 3 | 0xd135...34cab3 | 42000.00K | 7.00% |

| 4 | 0x5b95...243e4a | 36750.00K | 6.12% |

| 5 | 0x8457...0666bc | 31800.00K | 5.30% |

| - | Others | 347579.17K | 57.94% |

II. Key Factors Influencing LCAT's Future Price

Supply Mechanism

- Market Competition: Intense market competition in low-end production capacity has led to price declines and overcapacity.

- Current Impact: High-end products still rely on imports, with slow progress in domestic substitution, resulting in a shortage of high-end product supply.

Macroeconomic Environment

- Monetary Policy Impact: Macroeconomic trends play a significant role in influencing LCAT's exchange rate with fiat currencies.

- Geopolitical Factors: International trade levels and forecasts from organizations like the UN and IMF can impact LCAT's value.

Technical Development and Ecosystem Building

- AI Integration: AI models are being integrated into trading systems, though their accuracy in extreme market conditions requires long-term validation.

- Ecosystem Applications: The cryptocurrency market inherently carries risks, which affects the development of ecosystem applications.

III. LCAT Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.00785 - $0.00913

- Neutral prediction: $0.00913 - $0.01114

- Optimistic prediction: $0.01114 - $0.01315 (requires positive market sentiment and increased adoption)

2027-2028 Outlook

- Market phase expectation: Potential growth phase with increased volatility

- Price range forecast:

- 2027: $0.01104 - $0.01472

- 2028: $0.00906 - $0.01546

- Key catalysts: Technology upgrades, partnerships, and broader crypto market trends

2029-2030 Long-term Outlook

- Base scenario: $0.01470 - $0.01654 (assuming steady market growth)

- Optimistic scenario: $0.01837 - $0.02232 (assuming strong adoption and favorable regulatory environment)

- Transformative scenario: $0.02232+ (in case of major breakthroughs or widespread integration)

- 2030-12-31: LCAT $0.02232 (potential peak based on optimistic projections)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.01315 | 0.00913 | 0.00785 | 0 |

| 2026 | 0.01515 | 0.01114 | 0.00657 | 22 |

| 2027 | 0.01472 | 0.01314 | 0.01104 | 44 |

| 2028 | 0.01546 | 0.01393 | 0.00906 | 52 |

| 2029 | 0.01837 | 0.0147 | 0.01146 | 61 |

| 2030 | 0.02232 | 0.01654 | 0.01488 | 81 |

IV. LCAT Professional Investment Strategies and Risk Management

LCAT Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Long-term investors and crypto enthusiasts

- Operation suggestions:

- Accumulate LCAT tokens during market dips

- Monitor project developments and community growth

- Store tokens in a secure wallet with private key control

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential reversals

- Relative Strength Index (RSI): Helps in determining overbought or oversold conditions

- Key points for swing trading:

- Set clear entry and exit points based on technical indicators

- Monitor trading volume for trend confirmation

LCAT Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple crypto assets

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- web3 wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Hardware wallet for long-term holdings

- Security precautions: Enable two-factor authentication, use strong passwords

V. Potential Risks and Challenges for LCAT

LCAT Market Risks

- High volatility: Meme tokens are subject to extreme price fluctuations

- Market sentiment: Heavily influenced by social media trends and community engagement

- Competition: Increasing number of meme tokens in the market

LCAT Regulatory Risks

- Regulatory uncertainty: Potential for stricter regulations on meme tokens

- Cross-border restrictions: Varying legal status in different jurisdictions

- Tax implications: Unclear tax treatment for meme token transactions

LCAT Technical Risks

- Smart contract vulnerabilities: Potential for exploits or bugs in the token contract

- Blockchain congestion: High network fees during peak trading periods

- Technological obsolescence: Risk of being overtaken by more advanced projects

VI. Conclusion and Action Recommendations

LCAT Investment Value Assessment

LCAT presents a high-risk, high-reward opportunity within the meme token space. Its AI-powered tools and strong community support offer potential for growth, but investors should be aware of the extreme volatility and regulatory uncertainties associated with such tokens.

LCAT Investment Recommendations

✅ Beginners: Invest only small amounts you can afford to lose; focus on learning about the project ✅ Experienced investors: Consider LCAT as part of a diversified crypto portfolio; implement strict risk management ✅ Institutional investors: Approach with caution; conduct thorough due diligence and consider regulatory implications

LCAT Trading Participation Methods

- Spot trading: Buy and sell LCAT tokens on Gate.com

- Staking: Participate in staking programs if offered by the project

- Community engagement: Join official social media channels for updates and potential airdrops

Cryptocurrency investments are extremely risky, and this article does not constitute investment advice. Investors should make decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What crypto has the highest price prediction?

Bitcoin has the highest price prediction, forecasted to reach $139,249 at its peak. Chainlink follows with a predicted high of $59.67.

What is the price prediction for Catzilla 2025?

Catzilla's price prediction for 2025 is $10, based on its presale token target. This forecast assumes strong meme-driven demand and utility development.

What is the price prediction for LRC in 2030?

Based on statistical models, LRC is predicted to reach around $0.038 by mid-2030 and $0.041 by the end of 2030.

What will the price of chainlink be in 2025?

Based on current projections, Chainlink's price in 2025 is expected to reach approximately $18.81, assuming a 5% annual growth rate from recent predictions.

why is crypto crashing and will it recover ?

2025 GROK Price Prediction: Potential Surge or Market Correction for the AI-Driven Cryptocurrency?

ANI vs XLM: The Battle for Artificial Intelligence Supremacy in Language Models

GORK vs SHIB: The Battle of Meme Coins in the Cryptocurrency Ecosystem

Is Lion Cat (LCAT) a good investment?: Analyzing the potential and risks of this new meme coin

2025 ANI Price Prediction: Analyzing Market Trends and Potential Growth Factors for Animoca Brands' Token

What is spot trading?

BTC Dominance at 59%: The $2 Trillion Rotation That Could Ignite Alt Season

Top Ethereum ETFs to Consider

Bearish candlestick patterns

Bitcoin Lifestyle